unified estate and gift tax credit 2021

It consists of an accounting of everything you own or have certain interests in at the date of death Refer. You were domiciled and maintained a primary residence as a homeowner or tenant in.

The amount you can give during your lifetime or at your death and be.

. Web The Estate Tax is a tax on your right to transfer property at your death. Web The unified estate and gift tax is a tax imposed on property transfer especially by inheritance by will or as a gift. Most relatively simple estates cash publicly traded.

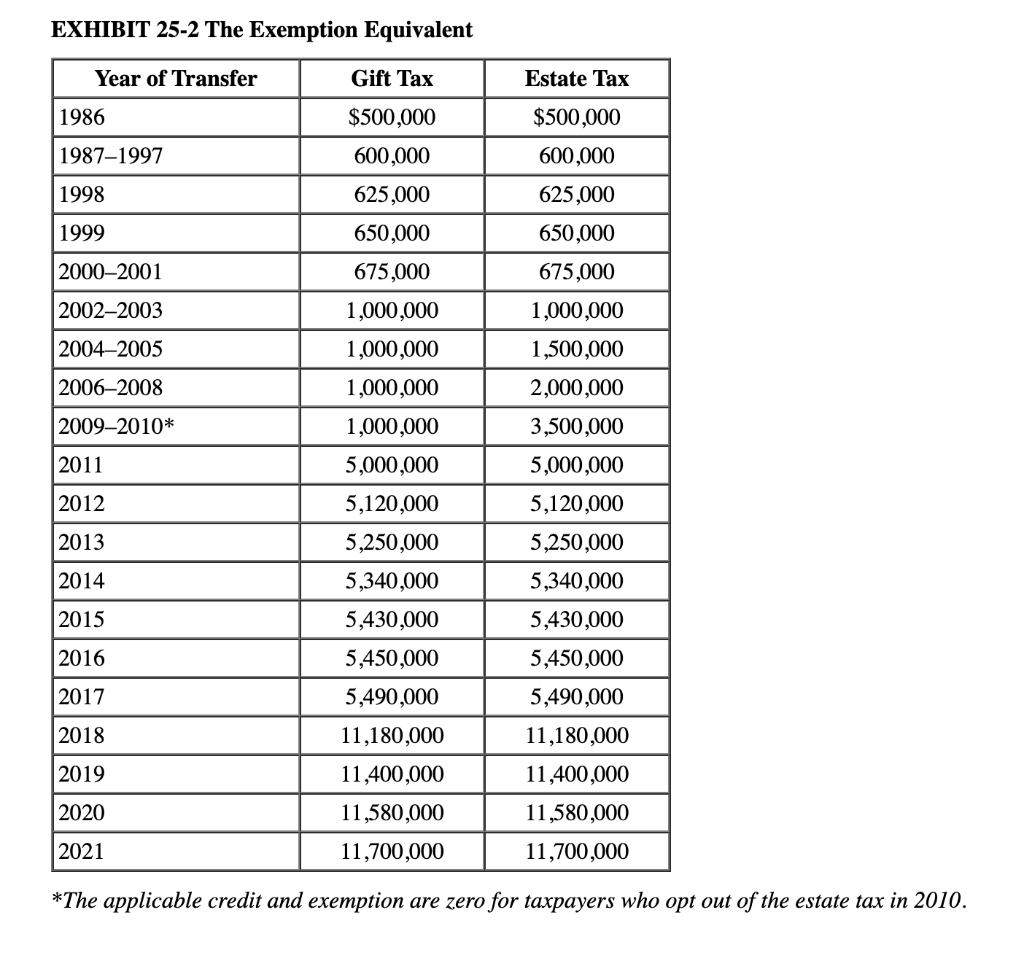

What Is the Unified Tax Credit Amount for 2022. Gift and Estate Tax Exemption. Web The chart below shows the current tax rate and exemption levels for the gift and estate tax.

In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. Web A taxpayer does not incur a federal gift tax liability until the aggregate taxable gifts made over the taxpayers lifetime exceed 5430000. Web You are eligible for a property tax deduction or a property tax credit only if.

Web Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. Web Or of course you can use the unified tax credit to do a little bit of both. Web Or of course you can use the unified tax credit to do a little bit of both.

As of 2021 you are able to give 15000 per year to. Highest tax rate for gifts or estates over the exemption amount Gift and. The unified tax credit changes.

All people are qualified to take advantage of this tax perk from the. Web The unified credit against estate and gift tax in 2022 will be 12060000 up from 117 million dollars in 2021. What Is the Unified Tax Credit Amount for 2021.

Web For the year 2017 the Federal estate and gift tax unified credit shelters up to 5490000 of taxable assets an amount known as the Federal Applicable Exclusion. Web Your available Unified Credit is effectively reduced from 1206 million to 12 million. The unified credit is composed of two different limits to.

So if you made a gift to your child of. Indicate whether you live in a home that you owned choose Homeowner or rented choose Tenant during 2021. Web The unified gift and estate tax credit is the current shelter amount for gifting during ones lifetime and at ones death.

Web The IRS has come out with the exemption amounts for 2023. Web The unified credit against estate and gift tax in 2022 will be 12060000 up from 117 million dollars in 2021. Most relatively simple estates cash publicly traded.

The unified tax credit changes. Web A unified tax credit allows you to gift assets without having to pay transfer taxes in some cases. If you die in 2022 after making such a taxable gift you will still be able to transfer.

Web The current federal unified estate and gift tax exemption of 117 million per person is set to automatically revert to approximately 6 million on January 1 2026. Web Property Tax DeductionCredit Eligibility. Web NJ Clean Energy- Residential New Construction Program.

Starting January 1 2026 the exemption will return to. Incentives depend on the HERS score and the.

How The Us Gift Tax Applies To Foreign Nationals Bny Mellon Wealth Management

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm

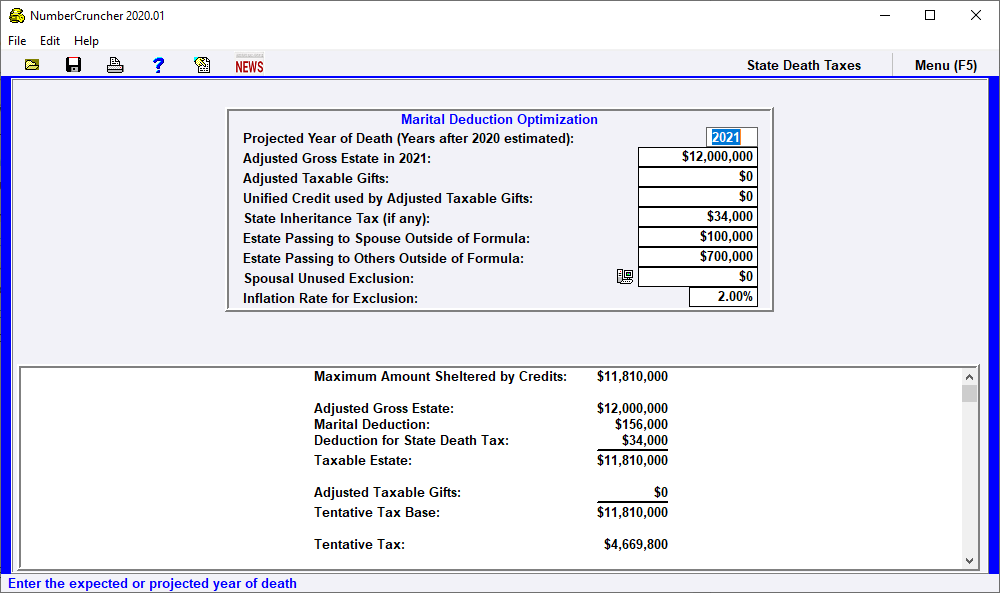

Mar Ded Marital Deduction Optimization Leimberg Leclair Lackner Inc

Warshaw Burstein Llp 2022 Trust And Estates Updates

Exploring The Estate Tax Part 1 Journal Of Accountancy

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Generation Skipping Transfer Taxes

Planning For Year End Gifts With The Gift Tax Annual Exclusion Miller Kaplan

What Are Estate Taxes Turbotax Tax Tips Videos

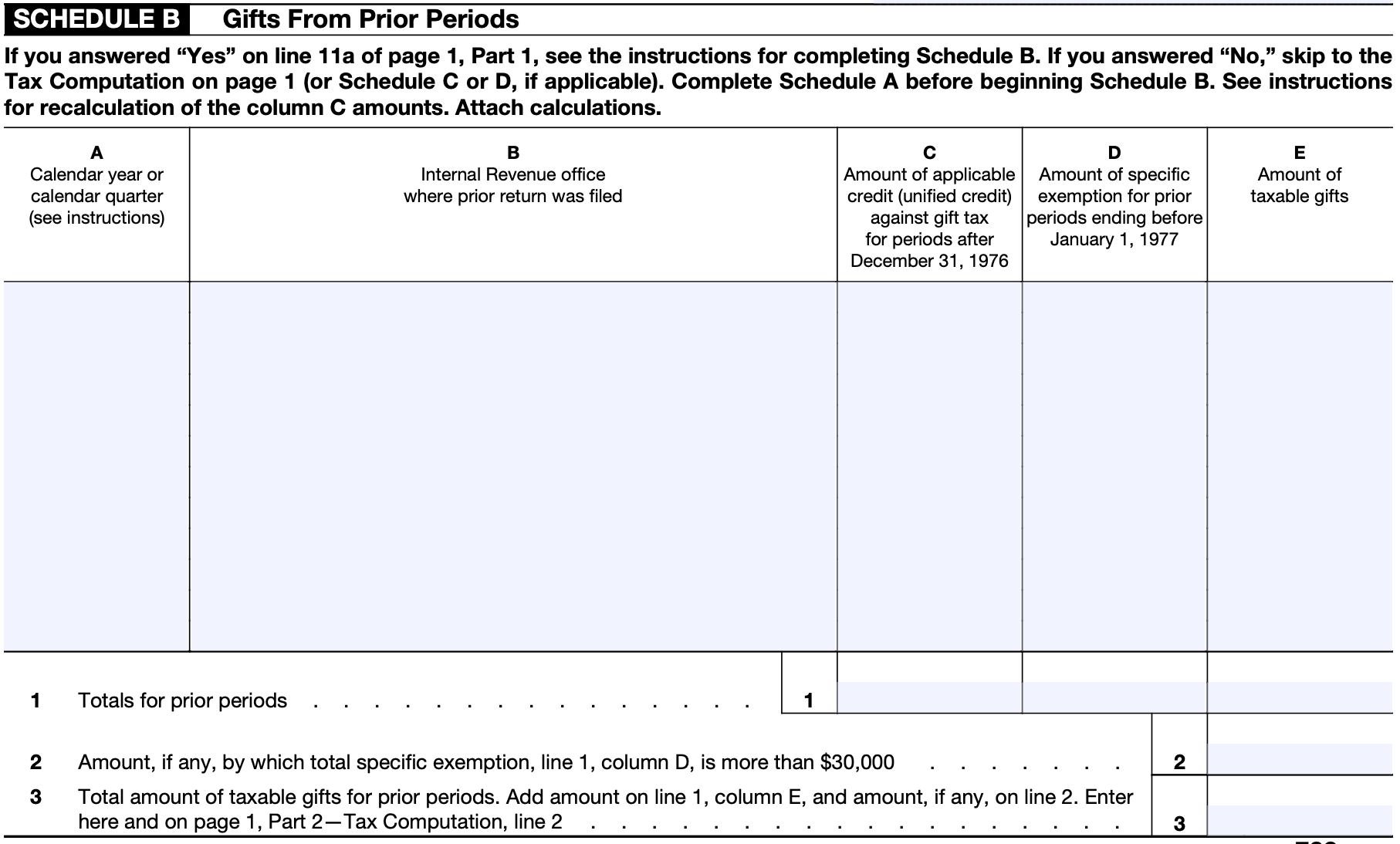

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

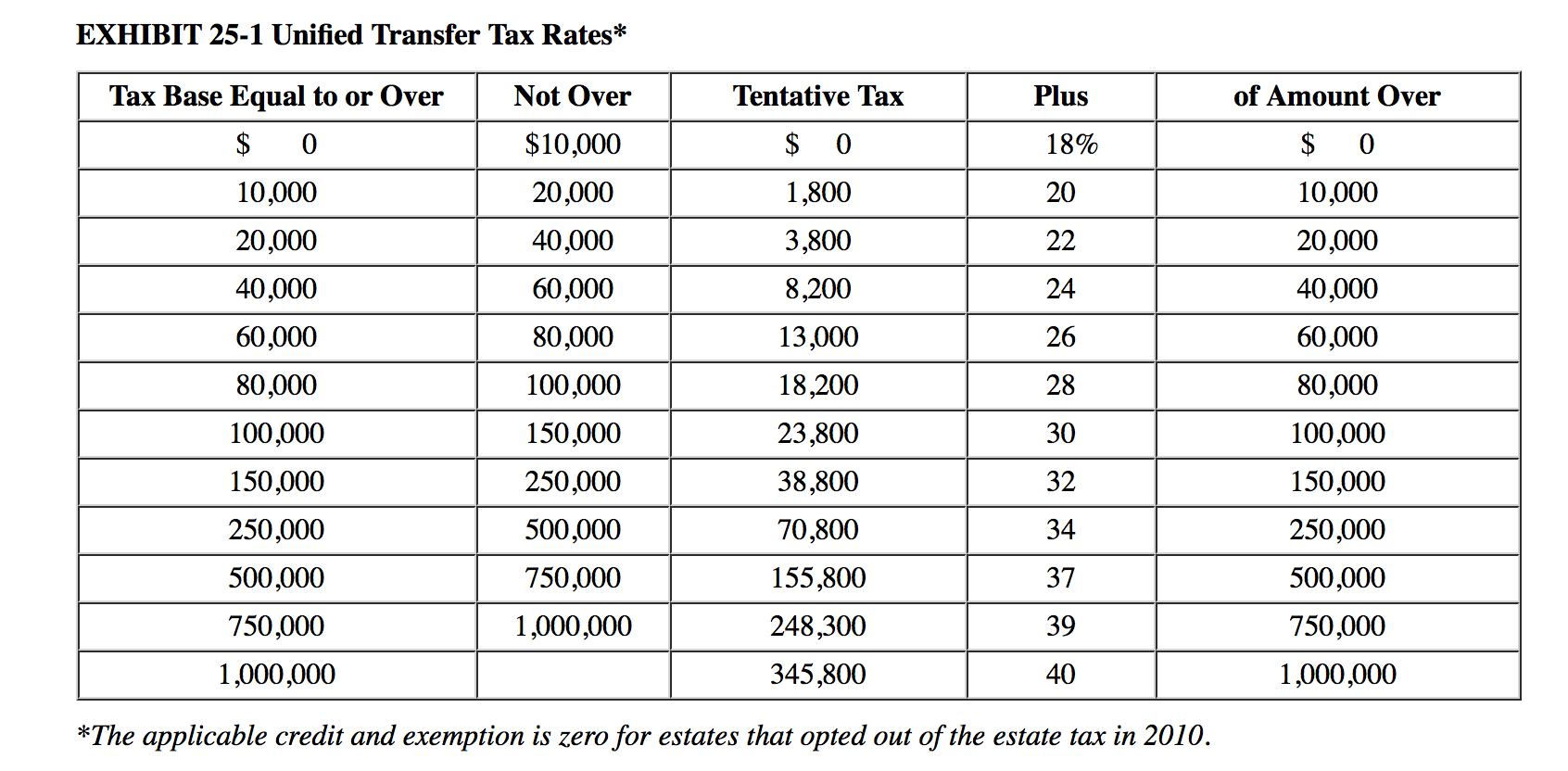

Solved Exhibit 25 1 Unified Transfer Tax Rates Not Over Chegg Com

Planning For Year End Gifts With The Gift Tax Annual Exclusion Somerset Cpas And Advisors

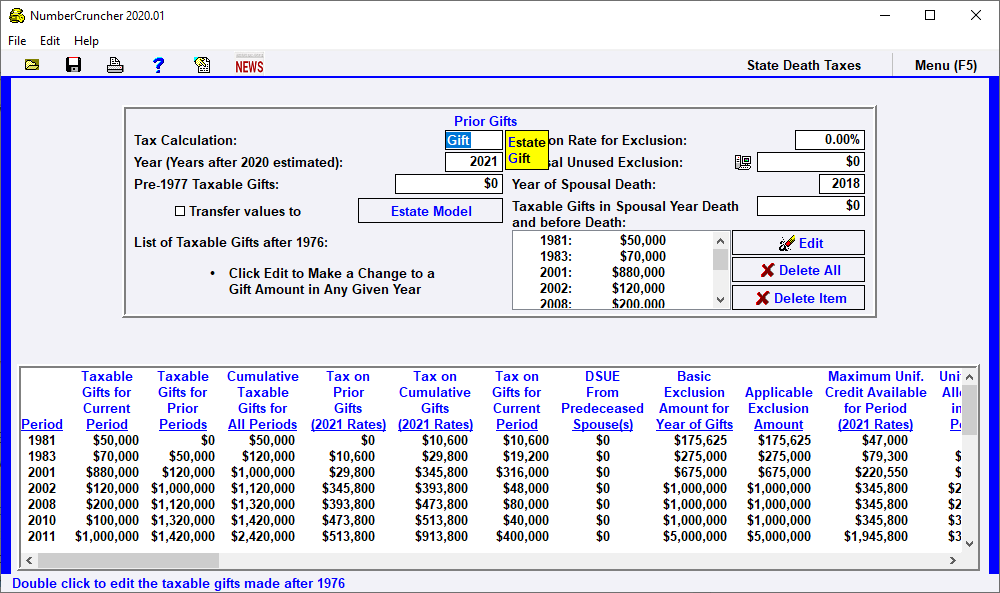

Prior Gifts Leimberg Leclair Lackner Inc

Planning For Year End Gifts With The Gift Tax Annual Exclusion Doeren Mayhew Cpas

Solved Exhibit 25 1 Unified Transfer Tax Rates Not Over Chegg Com

What Is The Federal Estate And Gift Unified Credit Geiger Law Office

2020 2021 Unified Tax Credit And Lifetime Gift Tax Exclusion Parisi Coan Saccocio Pllc

:max_bytes(150000):strip_icc()/WhatIsaUnifiedTaxCreditAug.92021-f598bf82c87b42a7b139f10953ad3850.jpg)